Get Reimbursed for Orthotics From HSA: Here’s How!

Not sure how to use your Health Savings Account (HSA) to get reimbursed for custom insoles? Here's how to access your HSA funds for orthotics to save on healthcare expenses and improve your foot health!

Updated October 7, 2024

There are a range of health benefit plans to choose from, each with its own specific benefits and coverage. A health savings account (HSA) can help you save money on medical, dental, and optometry-related costs and other qualifying medical expenses. An HSA can help you cut your annual taxes, adding to your overall savings.

Under a doctor's prescription, your HSA covers the expense of insoles, custom orthotics, and other assistive devices deemed necessary to manage conditions in the feet and lower limbs and aid in preventing these ailments from worsening.

Are Insoles HSA Eligible?

So, are orthotics covered by HSA?

In short, yes, you can be reimbursed from your HSA for orthopedic footwear products. However, as mentioned above, a prescription for custom orthotics, insoles, or orthopedic footwear must be deemed a viable treatment option by a medical doctor to be eligible.

In other words, you'll require a medical diagnosis related to the foot and lower leg that requires orthopedic footwear and related supportive devices to manage this condition.

The individual is responsible for the initial expense incurred from purchasing the item and can be reimbursed if it is deemed eligible for reimbursement under their plan.

At Upstep, you can use your HSA, FSA, and HRA dollars to buy custom orthotics as they are considered fully reimbursable.

» Looking for peace instead of going through the reimbursement process? Take a look at insoles for flat feet that can be customized to save you time and energy

How to Get Reimbursed for Orthotics From HSA

1. Obtain a Letter of Medical Necessity

To get your orthotics covered by insurance, you will need a letter of medical necessity (LMN) from a doctor or qualified healthcare provider. These include a podiatrist, a certified pedorthist (C. Per), or a prosthetic and orthotic professional (CPO or CO).

2. Get a Diagnosis and Measurement

The medical professional can provide you with a medical diagnosis or put you in contact with someone who can accurately diagnose your condition. They will then accurately carry out measurements necessary for orthotics sized to your feet. You may be required to cover the cost of the casting or impressions of your feet to manufacture the custom orthotics or footwear.

3. Submit a Claim to HSA or FSA

You will then need to submit a claim to your HSA or flexible spending account (FSA) provider with the correct details regarding the item purchases, date, and amount paid to acquire the item. Along with the letter of necessity, this will fully substantiate the reason for your claim.

4. Fill in the Reimbursement Form

On this reimbursement form, you must state the specific medical condition for which you've acquired the item, correlating with the medical diagnosis provided by the medical professional that you consulted. A signature is also required on the reimbursement form indicating that the item is for the individual, your spouse, or your dependent.

It is important to note that there is a period in which you'll need to submit the claim to your HSA or FSA, and it might have an additional cost attached to the claim.

How HSA Claim Fees Work

A claim fee is attached when making a claim that comes out of your HSA funds and will subsequently reduce the available funds in your HSA. You'll need to contact your provider regarding the specific fee attached to process the claim for reimbursement.

Combining multiple receipts as a single claim can help save you money, as submitting individual claims comes with individual fees for each claim. You can also save money by submitting your claim online, as online claims typically cost less than completing and submitting the claim in person.

It is vital to keep a detailed record of your expenses to prove that the expense was related to a specific product, deeming it eligible for reimbursement from your account and for tax purposes.

HSA Reimbursement Eligibility

A comprehensive list of specific healthcare, vision, and dental costs is used to deem the expense eligible for reimbursement for yourself, your spouse, or your dependent.

Custom insoles and orthotics, including related items, qualify for reimbursement when submitted with a medical diagnosis provided by a qualified healthcare professional, and all supporting documentation is provided. There are a number of foot conditions that orthotics are prescribed for, including flat feet, heel pain, and plantar fasciitis.

Items not directly related to the healthcare practitioner's medical diagnosis will not be covered by your HSA or FSA for reimbursement purposes.

We recommend you find out how much the custom orthotics cost and consult your healthcare provider regarding the eligibility for reimbursement for the specific item before purchasing it.

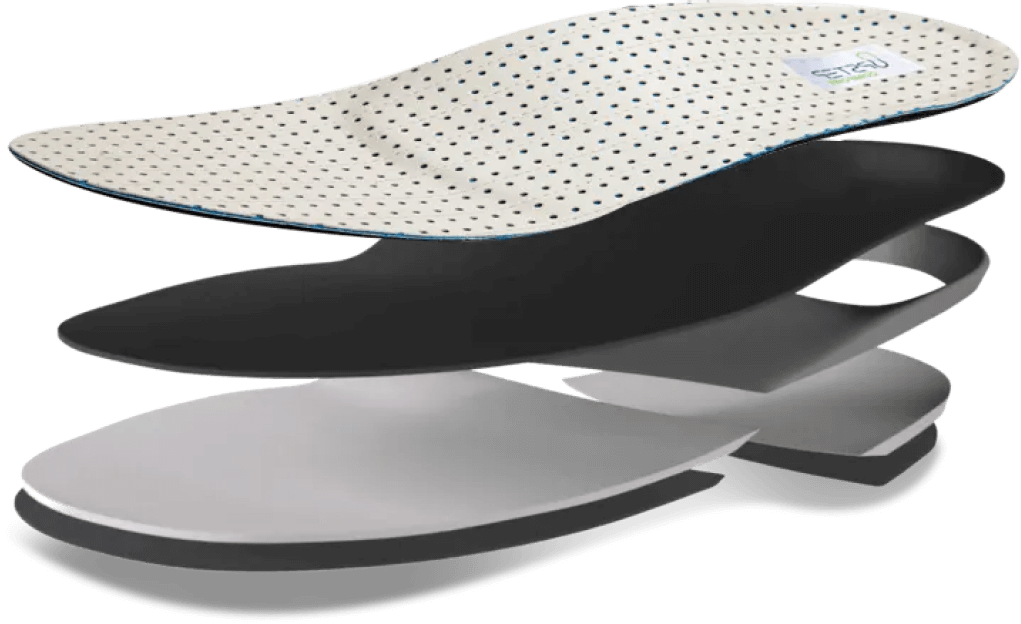

Maximizing Your HSA Benefits with Upstep's Custom Orthotics

Orthotics form part of several conservative treatments for foot conditions that should be explored before invasive measures are taken. Acquiring the correct orthotics, insoles, or assistive devices for foot diseases or complaints that you are experiencing is essential to managing your condition effectively.

Upstep is one of the best online custom orthotics providers, and Upstep's orthotics are fully covered by both HSA and FSA.